SMSF Loans Explained

What are the rules?

Self Managed Super Funds (SMSF) are allowed to borrow to invest in direct property, managed funds or shares as long as a Limited Recourse Borrowing Arrangement is used for the transaction.

What is a Limited Recourse Borrowing Arrangement (LRBA)?

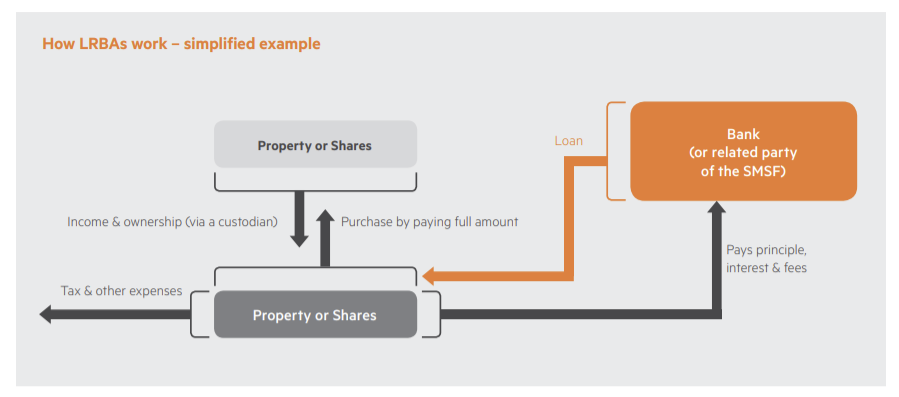

An LRBA is a financial arrangement which enables an SMSF to purchase property or shares with borrowed money. It is limited recourse because if the trustee defaults on the loan, the lender’s recourse is generally limited to the asset acquired which protects the value of the other assets of the fund.

Trustees are able to borrow from related parties of the fund including its members or from lending institutions. If borrowing from a related party specific rules need to be followed to ensure the loan is on commercial terms.

Since an SMSF cannot own an asset directly that is geared, the asset must be held on trust until the loan is repaid. A bare trust is established to hold the asset as custodian but the SMSF has full beneficial interest in that property or shares, and as a result will receive all rent paid by the tenants or dividends generated by the shares.

Your SMSF trustee pays interest on the loan and fees to the lender. In the case of a property it also pays for repairs, maintenance and property management expenses. These costs may be deductible to the fund.

One of the main attractions of borrowing to purchase shares or property within an SMSF is that capital gains are concessionally taxed. For example, a capital gain on a property held for longer than 12 months is taxed at only 10%, and in retirement pension phase any capital gains are tax free.

What are the options at the end of the term?

Borrowings are typically from 1-20 years. The SMSF has the option to:

- repay the loan and acquire full ownership of the asset, or

- sell the asset during the term – with the proceeds applied to the outstanding loan and other associated costs, with any leftover going to the SMSF

Who should use LRBAs?

LRBAs will suit those members of SMSFs who meet one or both of these criteria:

- need to build their retirement savings faster, or

- would like to hold a key property inside the low tax super environment (e.g. their business premises).

Important things to consider

Borrowing inside SMSF is not a simple process and professional advice is required.

Some points you need to be aware of include:

- a SMSF can only invest in assets which meet SIS regulations

- SMSF can only borrow to acquire assets if the trust deed allows, which may require a review of the SMSF trust deed and

investment strategy, and - You will also need to establish a security custodian (bare trust) to facilitate the acquisition,

- borrowed nds do not count towards contribution caps, and

- The loan used to purchase the asset can only be a limited recourse loan – which means the lender generally has no claim on any other assets in the SMSF other than the asset purchased with their nds. The lender may, require security over assets outside of your SMSF using personal guarantees.

If you would like to explore your financing options and SMSF lending, please go to www.smefundinghub.com and provide your contact details. Alternatively, contact a broker at info@smefundinghub.com.

The information on this website is provided for general information only and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from financial, legal and taxation advisers. Although every effort has been made to verify the accuracy of the information, we disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy, or omission from the information or any loss or damage suffered by any person directly or indirectly through relying on this information.

Source: Australian Unity https://www.australianunity.com.au › factsheets