The Berkshire Hathaway Way: Lessons in Investing & Compounding

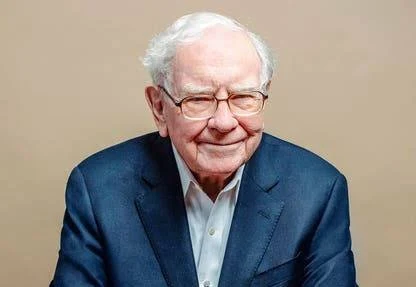

I recently was sent Warren Buffett’s news letter and now shared it with my clients here:

Boosting the Magic of Compounding – Warren Buffet

Here’s the summary (thank you to Warren Buffett and Morning Star for the link):

The Berkshire Hathaway Way: Lessons in Investing & Compounding

Warren Buffett’s latest shareholder letter not only reflects on Berkshire Hathaway’s remarkable long-term performance but also pays tribute to Charlie Munger—the “architect” behind Buffett’s evolved investment strategy.

Buffett initially focused on undervalued companies, but Munger shifted his mindset toward acquiring “wonderful businesses at fair prices.” This philosophy, combined with the power of compounding, helped Berkshire generate an annualized return of 19.7% from 1978 to 2023, far outperforming the market.

🔹 Key Takeaways:

✅ Patience beats impulse—Compounding rewards investors who stay the course, ignoring short-term noise.

✅ Quality matters—Companies with strong economic moats (brand strength, cost advantages, etc.) drive sustainable long-term gains.

✅ Concentration over diworsification—Buffett and Munger focused on a handful of top-tier stocks rather than excessive diversification.

Morningstar’s Wide Moat Focus Index applies similar principles—identifying businesses with enduring competitive advantages. The result? It has outperformed the market since 2007.

As Munger wisely said:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”